Keynote Speaker

Keynote Speaker

Books

In the media

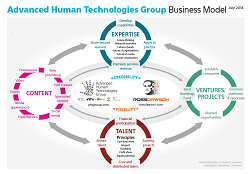

Business Model

Scenario Planning – Strategy for the future of global financial services

Recently futurist Ross Dawson gave a keynote on The Future of Global Financial Services at the Vision 2020 Financial Conference in Mumbai.

As a part of his presentation Ross described four possible scenarios for the future of global financial services, running through 10 driving forces, 10 critical uncertainties, and the resulting scenarios, as listed below.

* 10 Driving Forces for Global Financial Services

* 10 Critical Uncertainties for Global Financial Services

* A Scenario Framework for Global Financial Services

* Four Scenarios for Global Financial Services

DRIVING FORCES: GLOBAL FINANCIAL SERVICES

1. Economic shift

Economic power is shifting to the major developing countries. The BRIC countries (Brazil, Russia, India, China) together host close to half the world’s population, and their pace of economic development means that before long there will be multiple economic superpowers. In addition, global economic growth is shifting to the virtual, and developing countries will gradually wean themselves from primary and secondary industries to be significantly based on knowledge-based services.

2. Demographic shift

Demographics are the most predictable aspect of the long-term future (though we should not underestimate the potential for surprises here too). The image above shows the age profiles in 2050 for China, India, USA and Italy (See NationMaster for the original data and charts). Italy’s profile shows the challenges facing Western Europe. USA’s continued openness to immigration (and birth rate of immigrants) will support future prosperity. The very different age profiles of India and China suggest that India – with the right economic and educational policies – could see a relative rise in affluence over the next decades.

3. Greater expectations

We expect more. This is one of the most important trends across society and business, and it’s not likely to change. Becoming extreme in developed countries in terms of expectations of health, environment, transparency, service and far more, expectations will also soar in developing countries.

4. Commoditization

This chart shows that UK consumer prices for many products are consistently going down. One of the biggest impacts of globalization is increased competition and lower prices across commodity products, which encompasses an increasing proportion of the economy. Good for consumers, bad for producers.

5. Connectivity

Clearly connectivity is a fundamental and irreversible driver of change. Just one aspect of that is how customers are connected to their financial institutions. The image above shows a booth in a local branch of UK bank which is using ‘teleporting‘ technologies to put centrally-located financial planners in front of their customers nationwide.

6. Integration

Increased integration of information flows and applications will transform the flow of financial information, and the architecture of financial applications. XBRL (eXtensible Business Reporting Language) is an example of a standard that allows ready integration of financial reports across applications and organizations.

7. Modularization

Integration technologies are leading to a ‘modular economy’, in which business processes are being broken down into small elements that can be combined and recombined across organizational and national boundaries.

8. New payment mechanisms

While underlying interbank payment systems are unlikely to change dramatically, they way payments are made by individuals and companies is being transformed. From online and mobile payments to biometric authorization, new payment mechanisms will gradually supplant cash for most uses. The reality of black market economies means cash will never die.

9. New capital markets

Microfinance has already created new markets for capital. As I’ve often written before, I believe that new layers to markets for capital are essential and will emerge. For both the poorest, and also small emerging businesses, new markets will emerge. The wholesale shift to a knowledge-based economy with lower capital requirements needs to be matched with investors seeking broader participation in the economy.

10. Value of relationships

The value of relationships is nothing new, but paradoxically in a technology-driven world relationships are becoming even more important. Virgin Money’s business is only relationships – with its customers and suppliers of financial services.

CRITICAL UNCERTAINTIES: GLOBAL FINANCIAL SERVICES

1. Globalization

Despite the seemingly inexorable rise of global trade since the Second World War, this could be reversed. The rise of protectionist policies in the US are always a possibility, which could lead to an escalation of trade barriers globally, or a shift to unliteral and exclusionist trade deals.

2. National stability

The number of countries on the planet is definitely an uncertainty, as illustrated by the 16 countries that previously constituted the U.S.S.R. Most importantly, we should not assume that China will remain as one stable nation in the decades ahead. Similarly the landscape of the Indian subcontinent could change, and it would be unlikely to be a peaceful process.

3. Regulation

One of the biggest uncertainties for the financial services sector is national and international regulation. In particular, it will impact consolidation or fragmentation across the financial services sector, and the entry of new competitors to the market. The bill that Mr Sarbanes and Mr Oxley are signing into power above reflects the power of legislation.

4. Privacy

The future of privacy is fundamental to society and business. Across industries, the underlying issue is the balance between creating more customized and valuable services for customers, and the infringement of people’s sense of privacy. In particular, constraints on the abililty to share information between organizations will strongly impact the landscape.

5. Volatility

A deep uncertainty is the degree to which technological, structural and other changes could create greate market volatility and shocks to the financial system. Issues range across automated trading systems, derivative complexity, reliance on value-at-risk models, structure of new credit products and many more, all of which could lead to less predictable financial market structure and stability.

6. Industry structure

While the broad trend over the last two decades has been to consolidation in the financial services sector, this could change. If banks continue to be poor at cross-selling, investors could demand more focus and to choose for themselves which financial services sectors they participate in. Smaller innovators are likely to continue to rise – it is uncertain whether they will remain independent or aggregated into large businesses.

7. New entrants

British supermarkets are major financial services players today, eBay’s Paypal is a major payment platform, and Google has repeatedly applied for a banking license. There have already been new entrants into financial services from many industries. Certainly the major online players could become significant financial services participant, changing the current landscape.

8. Currencies

Consolidation of currencies is the accepted trend, but it may not continue. The stability of the Euro, for example, is far from inevitable. There is the potential for Internet-based currencies to emerge, which function outside of national jurisdiction or control.

9. IT Security

The rapidly evolving technological architecture for software and applications might – or might not – make banks more vulnerable to hacking and fraud. While overall IT security seems to be heading the right direction, vulnerabilities could emerge. The wildcard is the development of quantum computers, which would make all current bank encryption breakable.

10. Climate change

Possibly the most important uncertainty that faces us is the impact of climate change. There is a massive degree of unpredictability to how severe the impact will be, however the worse case scenarios would include wiping out a large proportion of the value of global real estate. The potential impact on the financial system is hard to imagine.

SCENARIO FRAMEWORK FOR GLOBAL FINANCIAL SERVICES

The classic scenario process identifies two dimensions to uncertainty, that when combined produce a matrix of four scenarios. Once the framework is created, the full richness of trends and uncertainties uncovered in the research process are integrated into the scenarios. Here the two dimensions selected are:

Aggregation: Fragmentation to Consolidation

From countries to companies to business processes, trends could push to greater or lesser aggregation.

Technology uptake: Traditional to Transformative

While strong technology uptake is inevitable, the degree to which this happens and is driven by consumer demand remains a vital uncertainty.

FOUR SCENARIOS FOR GLOBAL FINANCIAL SERVICES

NEW FRONTIER

* Strong global growth and availability of capital

* Deregulation and international cooperation

* India flourishes

* Google, eBay, and telecoms firms become major financial players

* Margin pressure across industry

* Rise of mobile payments and e-cash

* Shift away from branches

* Intensely customized service to all tiers of clients

BARRIERS RISING

* Rise of protectionism

* China splinters

* Euro breaks up

* Wealth disparities rise

* Investors demand focus

* Banks specialize/ global monolines

* Proliferation of intermediaries

* High margins for successful players

* Terrorism impacts financial markets and insurance

AGENT ECONOMY

* Fluid global economy

* Highly modular outsourcing across borders

* Governments lose control/ consumers gain control

* Consumers and business shift wholesale to online

* Agents seek best price for everything/ customer loyalty nil

* Constant product innovation

* Markets are volatile

* Customer service and call centers are automated

MEGA SERVICES

* Rise of BRIC results in multiple superpowers

* Trade liberalization wins

* Global financial services consolidation

* Integration across financial services sectors

* Profitability high but cyclical

* High customer expectations

* Banks diversify into other personal services, partly through alliances

* Niche service providers emerge to support the market leaders

STRATEGIES FOR GLOBAL FINANCIAL SERVICES

There are a wide variety of tools and approaches that can be used to apply scenarios to strategy development and implementation. These tools include testing current strategies across scenarios, risk management profiling, generating new strategic options, creating contingent strategies for unexpected conditions, and building organizational responsiveness to change.

WARNING: These are scenarios prepared for a presentation, so they are far from rigorous or comprehensive. True scenarios should have fully developed storylines that evoke the richness of how the scenario unfolds and could actually happen. To be truly valuable, scenarios need to be created for a specific organization or strategic decisions – generic scenarios are of limited value. Always work with someone highly experienced in the field – most consultants that claim to do scenario planning are making it up. The Driving Forces and Critical Uncertainties identified below are highly summarized, and would be presented and aggregated very differently in a real scenario project.

|

Contact

Energize your event with leading futurist and inspirational speaker Ross Dawson’s compelling and inspirational presentations that leave audiences stimulated. Contact Ross Dawson’s office today to discuss the precise keynote topic and title that will best meet your requirements. |